Content

Recruiters can trust that students who have passed the FMI exam have a high competency in financial modeling. Udemy, as we all know, is an online learning platform with a wide customer base. Well-known for its short-term and affordable certification courses, the platform is a win-all for anyone wanting to learn new in-demand skills at pocket-friendly prices. Over a decade of experience, they have refined and modified their training strategies to render an impactful learning experience to their delegates. They provide customized learning solutions for both online and classroom training experiences.

Next on our list of the best financial modeling courses in India is the Finance Edge institute. Driven by technical expertise and innovation, the institute aims to provide top-tier learning solutions in the domain of finance. IIM Skills is a leading institute that provides the best financial modeling courses in India.

To maximize the benefit of this course we recommend an understanding of financial statements and Microsoft Excel. FRM is a gold standard finance certification valued and accredited in 190+ countries. It is considered equivalent to a master’s degree in India & helps candidates find opportunities in top finance companies.

The Wall Street School is one of the top names in financial modeling courses in India as well as on the global level. However, every Institute can boast of unique features intrinsic to that particular organization. The best thing would be to research the institute well, sign up for a demo class, and/ or talk to an expert at the institute and then enroll in one of these programs. India has seen an upsurge in the demand for finance professionals adept at handling financial modeling and providing an accurate assumption of the business’ standing. Every industry is looking forward to recruiting competent financial modelers who are equipped to handle the various challenges and provide solutions for the growth of the business. You can take up jobs in the sectors of investment banking, corporate finance, equity research, private equity, and portfolio management among others.

SQL Learning

A limited time opportunity for rewarding our learners to upskill for free. However, with the right coaching and mentorship, it can be quite a seamless learning journey. It covers 2 modules- the Equity Derivatives Module and the Research Analyst Module and Offers a 1-month Equity Research Internship and Live Trading Sessions. Doing a course from a reputed institution won’t be enough if you want to be an expert in this field.

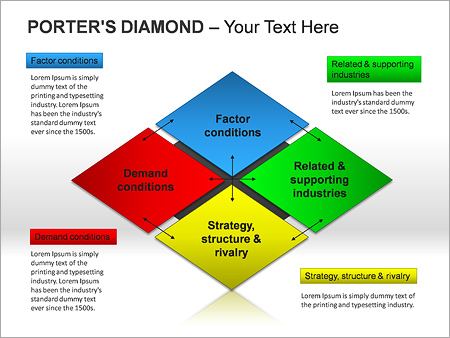

These are decisions that can make or break a company, or at least have a tremendous financial impact on the organization. Hence, companies are always in search of skilled financial modeling course in india professionals in the area. Before learning about the best Financial Modeling and Valuation Courses in India, let us first understand what the terms stand for.

Please complete this form and a NYIF Career Advisor will assist you.

The Financial Modeling Course with IIM SKILLS comprises 3 months along with practical assignments and a minimum of 5 case studies. There are certain points to consider when registering for financial modeling courses in India. They have to be extensive covering Valuation Methods, analysis of financial statements, and thorough idea of financial terms and concepts. Apart from that, the two most important considerations are post-course guidance toward skill development and practical projects. You have to have complete clarity on how many practical projects are incorporated into the training program.

Financial Modelling is a professional course provided by institutions to help candidates or students learn how to create a brief summary of the financial situation of a particular company. Take your business to new heights by ensuring your team’s competence in financial modeling. The FMI are the industry experts at validating skills in financial modeling. Our members regularly enroll in their accreditation exam, to complement their CFA, and their careers are richer for it. 100 years of essential education for finance professionals delivered by leading industry experts.

They take students from varied educational backgrounds such as CA, MBA, CFA, Engineers, fresh graduates, and other working professionals. But, you require to pass an eligibility interview to be admitted to the program. First and foremost, you should know what this financial modeling course is all about and why you should learn it. In a nutshell, financial modeling is the task of creating an abstract model to represent how a business, project, or financial asset is performing. These models are used mainly by financial analysts to evaluate a company’s performance and to predict its future.

Top 8 Financial Modeling and Valuation Courses in India

Drive career momentum with a distinguished financial modeling accreditation that validates your financial modeling skills. Be recognized for your expert experience, skills, leadership, and contributions to the field of financial modeling. This is a real model of the industry made from scratch using real world assumptions and calculations. You will learn what it means to work in a industry level financial model from zero.

Instructors are not only experts in their subject, but also friendly and approachable. However, it is expected that you have some understanding of Excel and financial concepts. So, this course will be more beneficial for students with finance, commerce, banking, economics, statistics, or mathematics background.

Course Curriculum

It is the process of creating a summary of a company’s expenses and earnings in the form of a spreadsheet that can be used to calculate the impact of a future event or decision. We hope that with this detailed article on Financial Modelling you have received an in-depth understanding of what the profession looks like and what to expect. If you are interested in getting into this exciting and equally dynamic field, then pursuing a CFA degree post this course is the direction to take. To know more about the Chartered Financial Analyst course click on the WhatsApp icon at the side of this blog and get in touch with our experts directly. Here are the course-wise eligibility criteria to help you prepare better for Financial Modelling courses. You need NOT to burn thousands on expensive courses that just make you cram the concepts.

- From Investment Banking to equity research to Excel and FRM, there are multiple options at hand.

- You will be granted access to a Learning Management System (LMS), comprehensive notes, pre-recorded videos, discussion forums, hands-on Excel training, and case studies.

- They are fundamental courses to establish a foundation or review the basics.

- The Financial Modeling Course by IMS Proschool is an ideal pick among the Financial Modeling and Valuation Courses in India.

- Financial modelling, as a profession, is gaining massive popularity in India and abroad.

- It’s up to you to choose customized courses as per your area and level of expertise.

Some of their other features are understanding flowcharts or how to acquire customers and revenues. Udemy is one of the most sought-after online ed-tech platforms that offer a variety of courses in different disciplines to upskill and move your career towards greater success. The course has been meticulously prepared and is ideal for professionals coming from commerce and finance-related education backgrounds. Students with an interest in mathematics, statistics, and business mathematics will find this course extremely helpful. The only pre-requisite to registering in the course is basic knowledge of computers and familiarity with fundamental finance terms and jargon.

The AFM accreditation is the global standard in financial modeling.

There are practical assignments and hands-on training guided by industry experts. The curriculum is updated regularly keeping into account the changes that happen in the finance domain. There are several practical assignments to give you an idea of how financial modeling is done for businesses in the real world. Most of the job opportunities after the financial modeling course are in the finance sector.

- The FMVA program can help you establish or boost your career in Equity Research, Investment Banking, Private Equity, Financial Planning, and Analysis or Corporate Development areas.

- Focused on job orientation, the well-qualified mentors equip you with industry insights, tips, and techniques to prepare you for the real market.

- IIM SKILLS offers more of a practical learning experience to its students.

- Financial Modeling is the art and science of creating dynamic financial models that further aid in various business-related decision-making processes.

The trainers of this course are ex-consultants and ex-investment bankers who bring real-world business problems to the classroom. The batches of these financial modeling courses in Hyderabad are available on weekends and weekdays. They offer 100% placement assistance and provide contact details of previously placed candidates to ensure transparency.

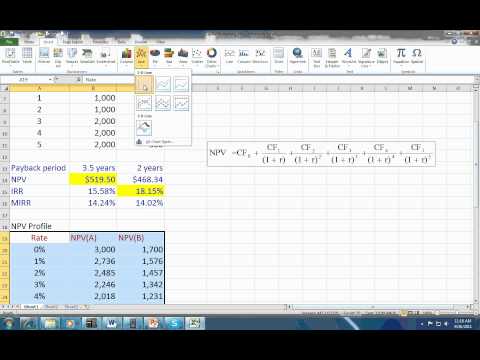

The five building blocks of an economic model are Historical data, ratios & matrics, assumptions, forecast, and valuation. I have co-founded Pristine Education and till date taught Financial Modeling to 100s of individuals in investment banks, equity research firms etc. Achievement of an FMI certification is a strong differential among our students.