QuickBooks Online has a special account specifically for these funds in transit. Unfortunately, the Undeposited Funds account in QuickBooks Online is one of the most misunderstood accounts — and one of the accounts most likely to cause a business’s financial statements to be incorrect. Before you carry out any clean up run your income statement and make a note of your income and profit number.

Every QuickBooks Online file has an Undeposited Funds account. This account is created automatically as part of your business’s chart of accounts and cannot be deleted. If you try to do so, QuickBooks Online will just create a new Undeposited Funds account for you.

You now know how Undeposited Funds works in QuickBooks Online. You can see the Deposit to for this Sales Receipt is Undeposited Funds. You can click on the blue hyperlink for the record (in this example it’s “Deposit”) to open the record and learn more. The information provided here is not investment, tax, or financial advice. You should consult with a licensed professional for advice concerning your specific situation. When you go back to the Make Deposit form, you will no longer see the payments.

Undeposited Funds on a Balance Sheet

And the purpose of this example is for the situation when you have a lot of really old transactions. I’ve seen it, for example, when a conversion’s gone through and one company had hundreds and Journal Entry Template Download Free Excel Template hundreds of transactions from 2006 or something that were recorded as undeposited. In this case, we only have a few, because I’ve only made a few, but imagine if you have hundreds of these.

Every QuickBooks Online file has an undeposited funds account that is generated automatically when the file is opened. This account tends to create a lot of confusion with new and seasoned users alike. Most QuickBooks Online users find it easier to always post to the Undeposited Funds account first, and then enter the deposit into QuickBooks Online separately. Doing this does result in an additional step, but memorizing one way of recording payments is easier than having to remember multiple processes. For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200.

After you have finished your clean up run the reports again – you will be amazed at the difference! You can make decisions for your business, and you won’t be paying tax on profit that is not real. If you have recorded the customer payment to the bank, and also added the bank entry as a sale, then your bank balance will also be incorrect. You will be able to see that when you compare the bank balance to the QuickBooks balance on your Banking or Transactions tab. It’s very important as it shows the inflow-outflow of payments. It is necessary to complete this process with proper articulation to ensure that we maintain the accuracy of payments.

When the deposit clears the bank, you will be able to match the deposit in your bank feed. If you don’t use the bank feed function in QuickBooks Online, you will still be able to easily reconcile the deposit when you get your bank statement. Your customer has given you a payment for goods purchased or services rendered.

What is Estimate in QuickBooks Online?

We believe everyone should be able to make financial decisions with confidence. Because your funds are not immediately paid out from Stripe, your Stripe funds remain in your Stripe Balance until a payout is made from Stripe. This is reflected in QuickBooks as Undeposited Funds or Payments to Deposit. (Technically, this account could have any name, but these are the most common two names – Account Type in QuickBooks Online will always be Undeposited Funds). The ones that are marked “journal” are trust deposits and should be deposited into the trust/IOLTA account.

- The funds you initially posted to undeposited funds remain in there.

- It also deleted the error from the particular Banking entries, and after that, the real amount is added with the right details.

- This is important—not only to make sure no income is missing and everything is reported only once.

- Because your funds are not immediately paid out from Stripe, your Stripe funds remain in your Stripe Balance until a payout is made from Stripe.

So we’re going to have a quick look at the balance sheet first because you know, I always love to start there. Now I’m going to have a quick look at the profit and loss just so we can see what these numbers are now and what they become later. So at the moment, we have sales of $95,675, and I’m just making a quick note of that. And we have a profit, this is theoretically what we’re paying tax on of $26,063. So first thing I’m going to do is pop to this bank feed and I’m going to have a look in categorized.

He already paid his bill and does not want to receive a past-due notice! The purpose of the undeposited funds account is to help you record which client paid against which invoice, especially when money is being deposited in bulk. Use the Undeposited Funds account to hold invoice payments and sales receipts you want to combine. It’s like the lockbox (or drawer) you keep payments in before taking them to the bank.

BudgetEase Blog – Making YOU Profitable™

You pay taxes based on the net income of your business. With an incorrect Undeposited Funds balance, chances are high that you are overstating your profit and paying too many taxes. Are you using QuickBooks Online to track your client sales? Whether your client pays you at the time of purchase or later determines if you should use a Sales Receipt or an Invoice.

That way, you can send and accept payments without unnecessary confusion and frustration. The only time you’ll have to pay is when you want to upgrade your account to PLUS and get paid even faster. Undeposited Funds and your Stripe Balance should always match with minor exceptions, like if you have specific fees that only appear upon payout. These fees or special charges will be missing in Undeposited Funds and will be reconciled upon payout into a bank deposit. In this video, I walk you through two methods on how to clean up your undeposited funds in QuickBooks Online.

Reconcile your balance sheet accounts every month.

Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction. You can download my free check list that will walk you through a monthly list of items to look at on your balance sheet to help ensure your reports are accurate. Think of the Undeposited Funds account as an envelope where you keep checks until you take them to the bank.

ReliaBills 2-Way Sync with QuickBooks

When that bulk deposit drops into your QBO bank feed, it is your responsibility to match the portion of the money to the right client’s outstanding payment due. To confuse matters more, some payment methods, like ACH or credit card, may have already subtracted a fee from the gross sum collected on behalf of the processor. You need to make sure that the client gets credited for the whole gross payment before any fees are subtracted.

This two-step process ensures Total Office Manager always matches your bank records. So, Once you have decided to clear the undeposited funds account, you can follow the below steps to do so. But do ensure that you reconcile the data first because only those entries should be deleted which have been already assigned to the bank register. In other words, The entry which is already posted everywhere and is no longer required to be reflected in the undeposited funds account should be cleared out. A buildup in undeposited funds is caused due to wrongly following the industry benchmark methods for the money-in transaction.

But, next, we’re going to walk through how to fix it the quick and dirty way, which is not my favourite way by any means, but it’s useful for if you have a lot of really old transactions. Gentle Frog is an independent bookkeeping company, we are not affiliated with Intuit QuickBooks or any bank. I’m going to click on the sales receipt for Diego Rodriguez.

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. As a result, It leads to an uncategorized income of your earnings and the payment itself stays as an undeposited fund. ReliaBills also sends updates and creates a streamlined process for your receivables.

What are the Undeposited Funds in QuickBooks Accounting Software?

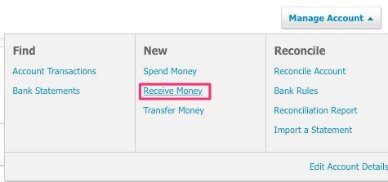

As a QuickBooks ProAdvisor, I agree that the main dashboard can provide a clear sense of your organization and workflow. Using Pareto’s Principle, we know that 80% of the time, standard workflows are the order of the day. But when it comes to accounting, 20% of transactions are enigmatic. Those transactions could result in your sanity going right out the window—along with your ability to file an accurate tax return. Basically, you are changing the Deposit To selection from “Group with Other Undeposited Funds” to a bank account.

Not having done that correctly, would’ve made it look like you had made $10,000 more and in theory, you could’ve paid tax on those $10,000. If you, if this account, or back in the balance sheet of the account, it’s increasing and not clearing down to zero regularly, it’s a good idea to check out what’s happening. You may now think you should always use a sales receipt or bill payment to enter any cash received.

In this method, the incorrect entry in the Uncategorized Find is deleted. After that, the particular entry is made in your bank account. It is a temporary virtual space for holding the payment till the time you do not have the deposit slip.